As we hurtle towards an increasingly digital future, the way we handle payments and banking services is evolving at breakneck speed. Tokenization, once a niche concept, is now poised to reshape the entire landscape of financial transactions and services. In this comprehensive guide, we’ll explore how tokenization is set to revolutionize payments and Banking as a Service (BaaS), and what this means for businesses, consumers, and the financial industry as a whole.

Understanding Tokenization: The Building Blocks of Digital Finance

Tokenization might sound like a complex concept, but at its core, it’s a simple yet powerful idea. Imagine replacing sensitive financial information, like your credit card number, with a unique string of characters that holds no intrinsic value on its own. That’s tokenization in a nutshell. It’s like giving your valuable data a disguise, making it useless to potential thieves while still allowing legitimate transactions to take place seamlessly.

But tokenization isn’t just about security; it’s a game-changer for the entire financial ecosystem. By converting assets and information into digital tokens, we’re opening up a world of possibilities for how we handle money, investments, and financial services. Think of tokens as digital Lego blocks that can be combined, transferred, and programmed in countless ways. This flexibility is what makes tokenization so exciting for the future of payments and banking.

Current Uses

In the realm of payments, tokenization is already making waves. Major credit card companies like Visa and Mastercard have been using tokenization to secure mobile payments for years. When you tap your phone to pay at a store, you’re not actually transmitting your card details. Instead, a token is sent, which can only be decrypted by the payment processor. This not only makes transactions more secure but also faster and more convenient.

Potential Uses

But the potential of tokenization goes far beyond simple payments. In the world of Banking as a Service, tokenization is set to revolutionize how financial products are created, distributed, and accessed. Imagine being able to instantly create a new savings account, investment portfolio, or loan product, all powered by tokens that represent real-world assets and value. This level of flexibility and speed could democratize access to financial services, making sophisticated banking products available to a much wider audience.

As we delve deeper into the role of tokenization in payments and BaaS, we’ll explore real-world applications, potential challenges, and the exciting possibilities that lie ahead.

Revolutionizing Payments: How Tokenization is Changing the Game

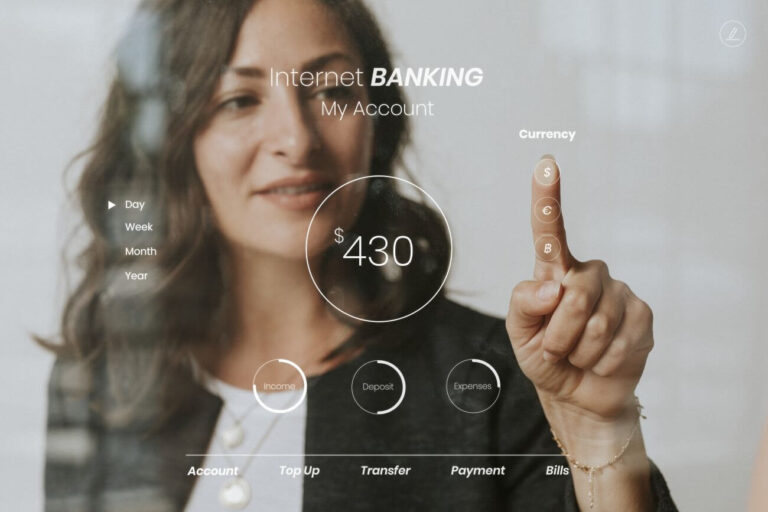

Gone are the days when carrying a physical wallet stuffed with cash and cards was the norm. Today, we’re moving towards a future where your entire financial life can be securely managed through digital tokens on your smartphone or other devices.

Mobile Wallets

One of the most visible impacts of tokenization in payments is the rise of mobile wallets and contactless payments. Services like Apple Pay, Google Pay, and Samsung Pay have become ubiquitous, allowing users to make purchases with just a tap of their phone. Behind the scenes, these transactions are powered by tokenization. When you add your credit card to a mobile wallet, it’s not actually storing your card number. Instead, it creates a token – a unique, encrypted code that represents your card. This token is what’s transmitted when you make a payment, adding an extra layer of security to every transaction.

Secure Online Payments

Thanks to tokenization, payments in the digital world go far beyond just mobile wallets. Consider the world of e-commerce, where card-not-present fraud has long been a major concern. Tokenization is helping to tackle this issue head-on. When you save your payment details on an online store, many retailers are now storing tokens instead of actual card numbers. This means that even if a hacker were to breach the retailer’s database, they’d only find useless tokens, not valuable financial information.

Tokenization is also enabling new and innovative payment methods. Take subscription services, for example. In the past, recurring payments often required storing sensitive card details, which could be a security risk. With tokenization, businesses can set up secure, automated payments using tokens, reducing the risk of fraud and making the whole process smoother for both the business and the customer.

Peer-to-Peer Transactions

Another exciting application of tokenization in payments is in the realm of peer-to-peer transactions. Services like Venmo and Cash App have made it easy to send money to friends and family, and tokenization plays a crucial role in securing these transactions. By tokenizing account information, these apps can facilitate quick and easy transfers without exposing sensitive financial data.

Future Possibilities

Looking to the future, tokenization could enable even more revolutionary payment methods. Imagine being able to program your payments based on certain conditions. For example, your car could automatically pay for parking using a token, or your smart fridge could reorder groceries and handle the payment seamlessly. These kinds of IoT-enabled, automated payments are made possible by the flexibility and security of tokenization.

Banking as a Service: Tokenization as the Catalyst for Innovation

Banking as a Service (BaaS) is rapidly emerging as a game-changing model in the financial industry, and tokenization is playing a pivotal role in driving this revolution. At its core, BaaS allows non-banking entities to offer financial services by leveraging the infrastructure and licenses of traditional banks. Tokenization acts as the technological backbone that makes this possible, enabling the secure and efficient transfer of financial data and assets.

One of the most exciting aspects of tokenization in BaaS is how it’s democratizing access to financial services. Traditionally, creating and offering banking products was the exclusive domain of large, established financial institutions. The barriers to entry were high, both in terms of regulatory compliance and technological infrastructure. Tokenization is changing this landscape dramatically. By representing financial assets and data as tokens, it becomes much easier to create, package, and distribute banking services.

Examples

Consider a fintech startup that wants to offer a new type of savings account. In the past, this would have required partnering with a bank, navigating complex regulatory requirements, and building extensive financial infrastructure. With tokenization and BaaS, this process becomes much simpler. The startup can use tokens to represent account balances, transactions, and other financial data. These tokens can then be easily integrated into the startup’s app or platform, while the actual financial operations are handled securely in the background by a BaaS provider.

This tokenization-powered approach to BaaS is also enabling the creation of highly customized and innovative financial products. For instance, imagine a travel app that wants to offer its users a specialized travel savings account with built-in currency exchange features. By leveraging tokenization and BaaS, the app could create this product without needing to become a bank itself. The account balances, transactions, and currency conversions could all be represented by tokens, making it easy to integrate these financial features seamlessly into the app’s user experience.

Additional Benefits

Tokenization in BaaS is also paving the way for more inclusive financial services. In many parts of the world, traditional banking infrastructure is limited, leaving large portions of the population unbanked or underbanked. Tokenization, combined with mobile technology, is allowing companies to offer basic banking services to these populations without the need for physical bank branches. A great example of this is M-Pesa in Kenya, which uses a form of tokenization to allow users to store and transfer money using just their mobile phones.

Another exciting application of tokenization in BaaS is in the realm of cross-border transactions. Traditionally, international money transfers have been slow, expensive, and opaque. Tokenization is helping to solve these issues by allowing for the instant, secure transfer of value across borders. Companies like Ripple are using tokenization to create a global network for cross-border payments, dramatically reducing the time and cost associated with these transactions.

As we look to the future, the combination of tokenization and BaaS is set to enable even more innovative financial services. We might see the rise of programmable money, where tokens can be imbued with specific rules or conditions. For example, a parent could give their child an allowance token that can only be spent on certain categories of items. Or a business could issue payroll tokens that automatically allocate a portion to savings or investment accounts.

Looking into the Future

The potential of tokenization in BaaS extends far beyond just traditional banking services. We’re already seeing the tokenization of real-world assets like real estate and art, allowing for fractional ownership and increased liquidity. As this trend continues, we could see the emergence of entirely new asset classes and investment opportunities, all powered by tokenization and made accessible through BaaS platforms.

In conclusion, tokenization is proving to be the secret sauce that’s making Banking as a Service not just possible, but transformative. By providing a secure, flexible, and efficient way to represent and transfer financial value, tokenization is enabling a new era of financial innovation. As this technology continues to evolve and mature, we can expect to see even more groundbreaking applications in the world of BaaS, ultimately leading to more accessible, diverse, and user-friendly financial services for everyone.

Promotional article

See also: